海關、 關稅、 GST

海關申報

美國海關和邊境保護局通常要求電子出口信息(EEI)備案,以用於包含單個商品價值超過2500美元的美國出口。

對於昂貴的包裝有一些複雜的規定。 我們強烈建議您將包裹分成幾部分,以使總價值低於2500美元。 如果無法重新包裝,我們必須為您準備一份EEI(電子出口信息)表格。 此項服務需要支付40美元的費用,並且需要EEI表格的包裹必須在郵寄期間通過特定的運輸商運送。

您必須為運送給我們的每個包裹填寫您的海關申報表,無論其運送到何處。您的報關單不僅用於國際清關處理,而且還是用於保險目的的理賠金額。

如果您不填寫海關申報表,我們將無法將您的包裹運送給您。要了解更多信息,請觀看此視頻。

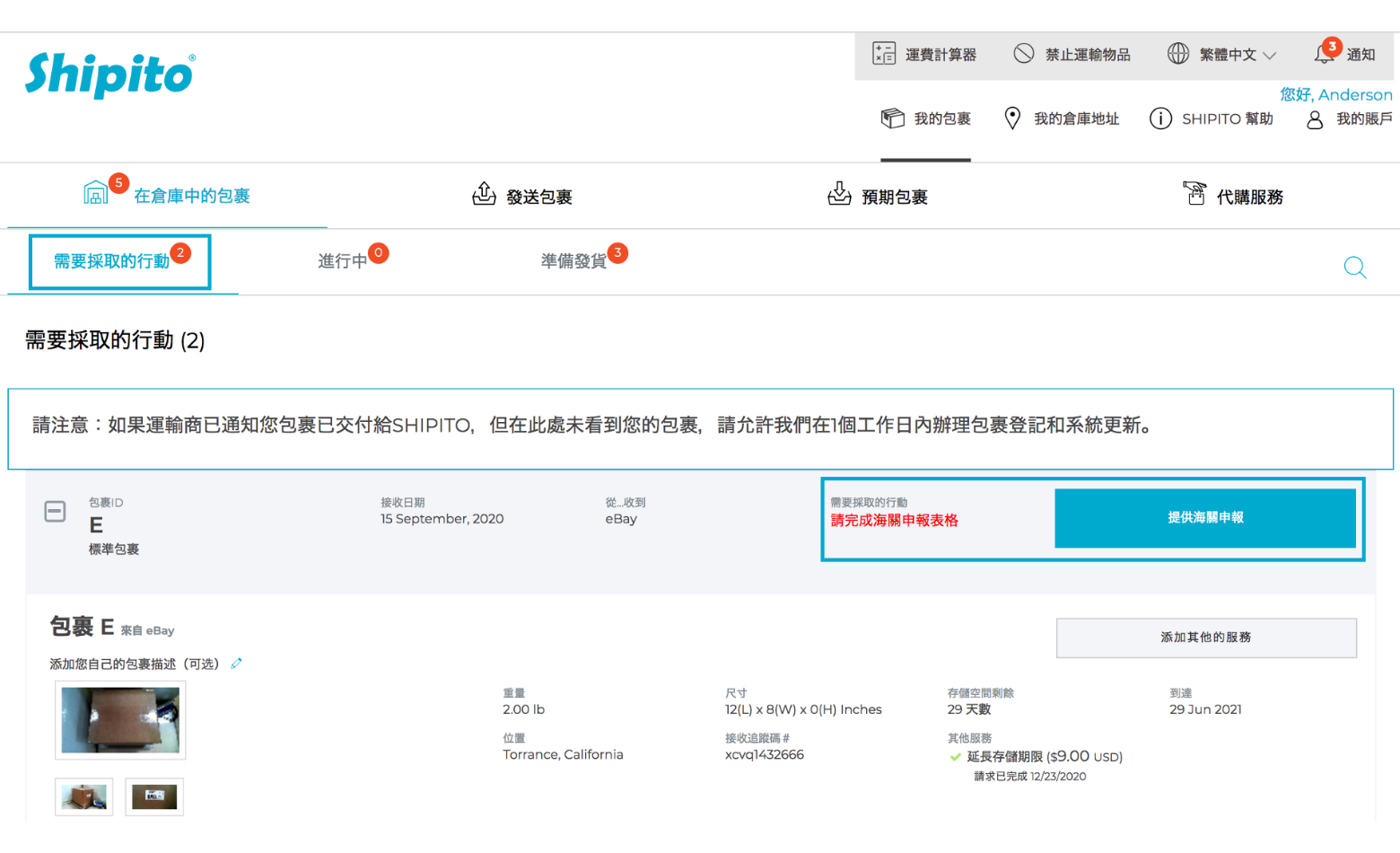

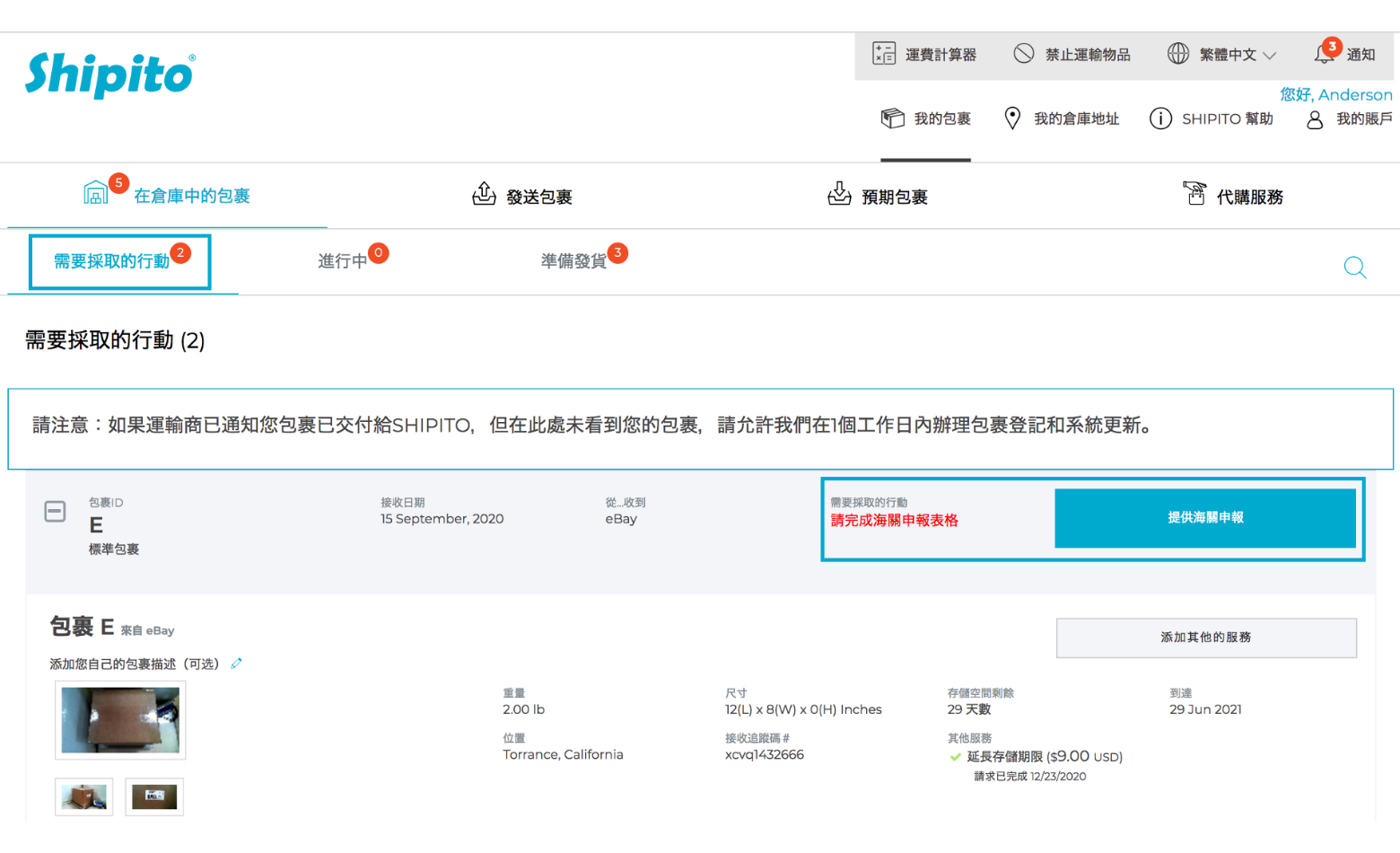

請按照以下步驟填寫您的報關單。

以下國家/地區不允許進口二手商品:

重要提示:

如果您不填寫海關申報表,我們將無法將您的包裹運送給您。要了解更多信息,請觀看此視頻。

請按照以下步驟填寫您的報關單。

- 登錄您的帳戶

- 點擊“倉庫中的包裹”

- 點擊“提供報關單”

- 填寫報關單

以下國家/地區不允許進口二手商品:

- 巴西

- 南非

- 烏干達

- 越南

- 印度尼西亞

重要提示:

- 選擇 GIFT 不會避免可能的關稅和稅款。

- 您必須指明包裹中是否包含電池或危險品。

- 如果您申報的金額不正確,您必須確定申報金額才能運送您的包裹。

- 任何報銷都基於申報價值,您有責任確保包裹一到貨就完整準確地申報。另請理解,我們無法對因包裹丟失造成的延誤提供任何賠償。報銷金額以申報金額或發票金額為準。

您報關的選項最終取決於您。 如果您收到該物品作為禮物或將物品作為禮物發送給收件人,您需要在報關單上註明“禮物”。 在所有其他情況下,您將選擇“個人商品”或“商業商品”。

如果您收到了免費或禮物的物品,您仍必須為該物品申報正確的金額。 請訪問此頁面以了解有關保險和理賠的更多信息。

是的,價值必須是美元(USD)。

是的,您對商品所產生的任何關稅和/或稅款負有經濟責任。我們建議您聯繫當地海關了解更多信息,因為關稅和稅費取決於所運送物品的目的地,出處和價值。這些規定可能隨時更改。

是的,您有責任支付所有清關費用,關稅或稅費。您可以通過以下兩種方式支付:

直接付款:直接聯繫包裹運輸商付款。

使用COD支付:如果您希望在包裹交付時付款,請在包裹到貨前2-3天聯繫Shipito,並向我們提供快遞公司的姓名,應付金額和跟踪號碼。最後,請將足夠的資金存入您的帳戶以完成COD付款。

如果您沒有提前繳納關稅和稅款,或者您的帳戶中沒有足夠的資金來支付費用,則包裹將被拒絕並可能退還給寄件人。

如果您沒有提前繳納關稅和稅款,或者您的帳戶中沒有足夠的資金來支付費用,則包裹將被拒絕並可能退還給寄件人。

是的,您必須填寫運送給我們的每個包裹的海關申報表,無論其運輸地點如何。您的報關單不僅用於國際清關處理,還用於保險目的。

澳大利亞 GST

從2018年7月1日開始,澳大利亞將向消費者和企業收取進口到澳大利亞的所有商品的商品和服務稅(GST)。

澳大利亞消費者現在需要為從國際零售商處購買的“低價值”商品支付10%的商品及服務稅,價值1,000澳元或更低。 Shipito收取這些商品的GST稅,並代表您直接向澳大利亞政府匯款。 GST稅是根據您運送的物品的價值,以及任何Shipito服務費和運費計算得出的

澳大利亞消費者現在需要為從國際零售商處購買的“低價值”商品支付10%的商品及服務稅,價值1,000澳元或更低。 Shipito收取這些商品的GST稅,並代表您直接向澳大利亞政府匯款。 GST稅是根據您運送的物品的價值,以及任何Shipito服務費和運費計算得出的

任何購買價值1,000澳元或以上的商品

任何價值1,000澳元或以下的商品

- Shipito 將 不會>收取商品及服務稅,您需要直接向澳大利亞稅務局匯款。

任何價值1,000澳元或以下的商品

- 如果您持有Shipito的ABN(澳大利亞商業號碼),您無需在郵寄時支付稅款,但可以通過常規季度納稅向澳大利亞政府提交費用。

- 如果您沒有在Shipito上存檔ABN(澳大利亞商業號碼),郵寄和處理費用將在寄出時評估10%消費稅

澳大利亞政府將就進口物品的價值收取10%的費用。額外的1/11費用將用於服務,保險和運費。

包裹集運,保險,超大包裹和運輸費用。

中國:關稅,稅收和進口限額

中國海關會對您的包裹全部價值進行評估計算關稅和稅收。

包裹送達後,您將向中國政府支付關稅和稅款。

對於包裹中有多件物品的個人貨物,其進口限額為1,000CNY。價值超過1,000CNY的物品,包裹中的多件物品必須清關為商業進口。如果包含多個項目,則值大於1,000CYN且聲明為個人使用的項目將必須退回美國。如果貨物只有一件物品,則沒有價值限制,但中國海關保留批准進口包裹或拒絕並返回美國的權利,無論其是否有1件或多件。

如果您每年進口價值20,000 CYN或以上的物品,則所有貨物必須作為商業進口清關。

新西蘭GST

從2019年12月1日開始,新西蘭將對進口到新西蘭的所有商品和服務向消費者和企業收取商品和服務稅(GST)。

現在,新西蘭消費者必須對從國際零售商處購買的,價值不超過1,000新西蘭元的“低價值”商品繳納15%的商品及服務稅。 Shipito會就這些購買收取GST稅,並代表您直接匯給新西蘭政府。 GST稅是根據您要運送的物品的價值加上任何Shipito服務費和運費來計算的。

現在,新西蘭消費者必須對從國際零售商處購買的,價值不超過1,000新西蘭元的“低價值”商品繳納15%的商品及服務稅。 Shipito會就這些購買收取GST稅,並代表您直接匯給新西蘭政府。 GST稅是根據您要運送的物品的價值加上任何Shipito服務費和運費來計算的。

對於$ 1,000 NZD新西蘭幣或以上的購買

Shipito將不收取消費稅,您必須直接將款項匯給新西蘭稅務局。

對於購買的$ 1,000 NZD或以下的商品

如果您在Shipito處備有新西蘭IRD,則無需郵寄支付稅款,但可以將其費用與常規季度納稅一起提交給新西蘭政府。

如果您在Shipito上未備有新西蘭IRD,則在發貨時將收取15%的商品及服務稅(GST),作為郵費和處理費。

對於購買的$ 1,000 NZD或以下的商品

15%的費用(向新西蘭政府支付了進口商品的價值)

+

這也將適用於服務,保險和運輸費用。

重要說明:由於內容價值和運輸方式分開,郵寄包裹時您會看到2項GST費用

+

這也將適用於服務,保險和運輸費用。

重要說明:由於內容價值和運輸方式分開,郵寄包裹時您會看到2項GST費用

- 登錄到您的帳戶

- 轉到“我的帳戶”

- 選擇“修改通訊簿”

- 在“稅號”空間中輸入“新西蘭IRD”。 您必須為運送到的每個地址列出新西蘭IRD

集運,保險,超重包裹和運輸費用。